Overview

Xers, millennials, and centennials face different challenges in home buying and saving. Millennials, with aspirations for stability, see homeownership as an important goal, but high costs and job insecurity limit their access, leading many to opt for peripheral locations and self-construction. In terms of savings, they seek long-term stability despite economic constraints. Centennials, on the other hand, prioritize flexibility, preferring to rent and manage their finances through fintech technology, opting for digital investments like cryptocurrencies. These differences underscore the need for policies and financial products that cater to the stability-seeking of one generation and the adaptability of the other, thereby driving the country's economic development.

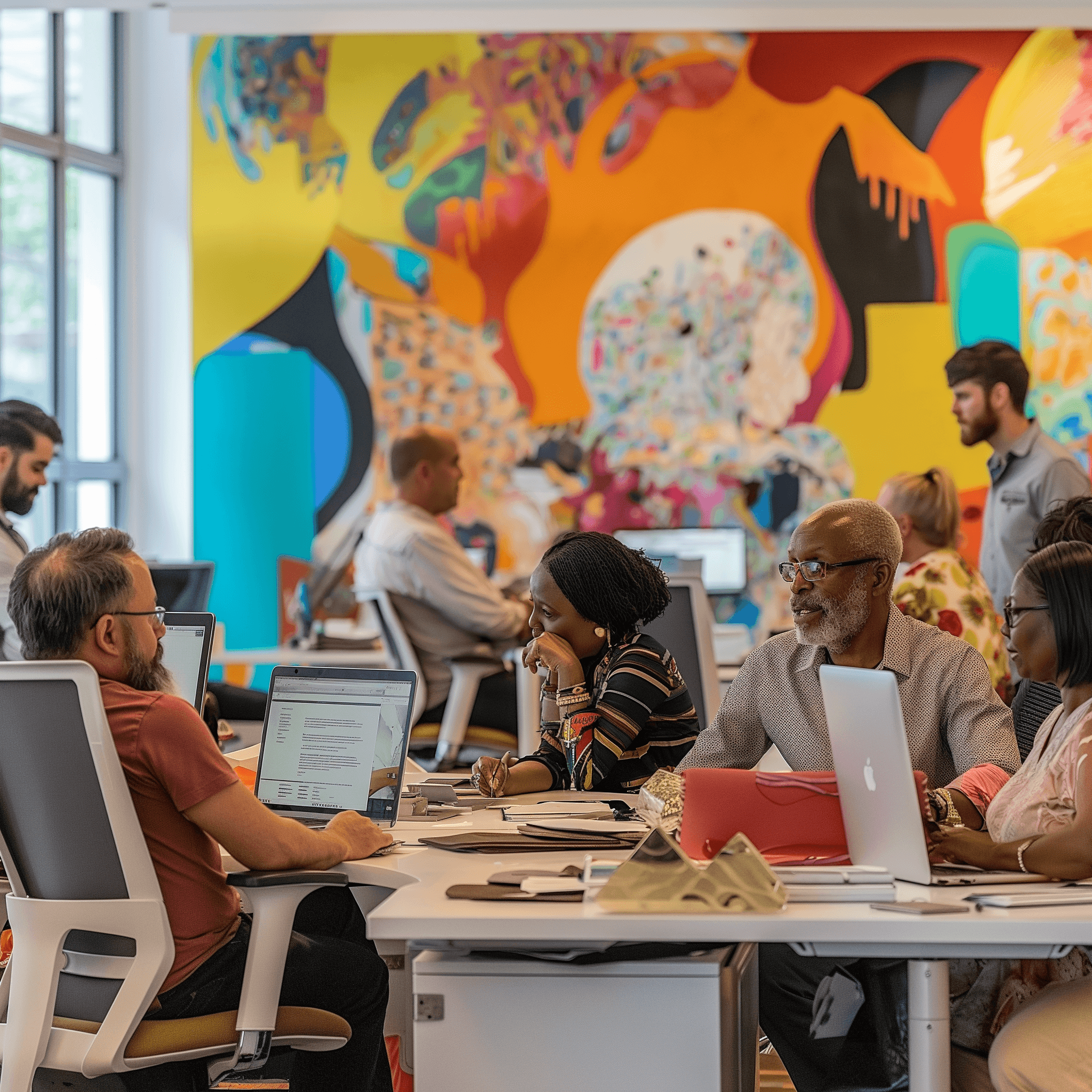

Xers, Millennials, and Centennials in Mexico: Differences in Home Buying and Saving

English: In Mexico, millennials (born between 1981 and 1996) and centennials (born from 1997 onwards) are facing a complex landscape regarding home acquisition and their saving habits. With a large proportion of the young population, the country faces the challenge of offering solutions that meet the specific needs of each group while driving the economy.

Home Buying

For Mexican millennials, homeownership remains an important goal and a symbol of financial stability. However, factors such as rising real estate prices and job insecurity have made access to this type of investment difficult. According to the National Housing Survey, only 30% of millennials have managed to acquire their own home, with many opting for self-construction alternatives or peripheral locations as a way to adapt to market limitations.

On the other hand, centennials show less interest in homeownership at a young age. Most are in the early stages of their working lives and facing economic uncertainties, this generation prioritizes flexibility and mobility, preferring rental options and shared housing models. This approach aligns with less pressure to accumulate assets and a greater appreciation for freedom and adaptability in their life choices.

Savings and Consumption

Regarding saving habits, millennials seek alternatives that provide long-term stability, although their saving capacity is limited by the cost of living and debt. According to data from INEGI, approximately 60% of millennials in Mexico have some form of formal savings, although many turn to investment funds and insurance as measures of financial protection.

Centennials, on the other hand, are strongly tech-oriented and choose fintech applications and digital saving tools to manage their finances. According to the National Financial Inclusion Survey, nearly 45% of Mexican centennials use mobile financial services and show interest in non-traditional investments, such as cryptocurrencies and micro-investments, prioritizing liquid and accessible options.

Implications for the Future

The population structure of Mexico, with a large base of young people, highlights the importance of adapting housing policies and financial products to the preferences and challenges of millennials and centennials. With one generation seeking stability and another prioritizing flexibility, the market needs to offer solutions that address these demands and contribute to the economic and social development of the country.

“

Thanks to the detailed studies by Ax Intelligences and the vision of Andrés, we have achieved a smooth collaboration between Madrid and Mexico. This synergy allows us to work together, combining local knowledge with a global strategic perspective, to offer truly effective solutions tailored to each client.

Guillermo Parodi, Madrid |Urban Hub

Related services

Founders Lab

GeoPulse Markets Assesments

Enterprise Services